The Therapy Sessions

Friday, May 12, 2006

Tax the rich more!

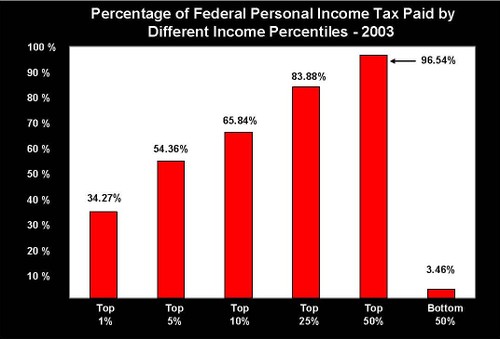

Everything you need to know about the US tax system:

I remember tables like this whenever I hear anyone blather on about "tax cuts for the rich..."

But I will make two points:

1. The graph describes income tax, not the payroll tax. Congress does not count the payroll tax in regular revenue, in order to give people - particulary misinformed people in lower tax brackets - the happy impression that they are socking money away for retirement.

If you believe that, the joke will be on you. Ha ha! Congress spent the money long ago! Have fun rubbing nickels together in your Golden Years, gramps!

Funny?

When Enron did it, it was illegal. But Congress makes laws, so they can get away with it....

2. How can you cut taxes for the bottom 50%? The payroll tax is regressive certainly, but it is off limits (by the order of Congress).

Shouldn't this demographic pay something ?